Indian Bank IFSC Code Finder – IFSC Code Search – MICR Code.

Indian Bank IFSC Code Finder – IFSC Code Search, List of IFSC Code, MICR code and address of 232 banks branches in india Find Verified IFSC code quickly to use for NEFT RTGS & IMPS transaction.

Select the Bank from Below List for IFSC Code and Branch details

Indian Bank IFSC Code – IFSC Code Search, List of all 232 banks in India is given below. Click for more information about the bank and its services. To find details of other banks, use the form below.

IFSC Code – Select Your Bank

What is IFSC Code?

Indian Financial System Code (IFSC), is a unique 11-digit alphanumeric code used for online fund transfer transactions done through NEFT, RTGS and IMPS. You can find the IFSC code on the check page provided by the bank. The Reserve Bank of India (RBI) assigns IFSC codes to banks. Apart from check leaf, you can also find IFSC code on the official website of bank and RBI.

When using net banking for money transfers, the IFSC code is essential. Banks typically don’t alter the IFSC code unless there is a merger. To transfer funds, you only need the beneficiary’s name, bank branch, account number, and the specific IFSC code, which varies for each bank branch. It’s crucial to input the correct IFSC code to prevent any mishaps, ensuring your funds reach the intended branch. With the correct account number and IFSC code, hassle-free transfers between accounts are possible at any time.

Table of Contents

Features of the IFSC Code

• helps to specifically identify a particular bank branch

• Reduces errors during the money transfer process

• Used with all electronic payment methods including NEFT, RTGS and IMPS

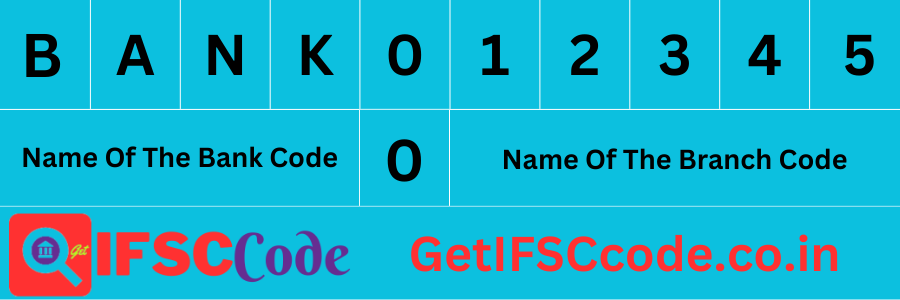

IFSC Format for Banks:

Magnetic Ink Character Recognition Code (MICR)

What is the MICR Code?

A specific bank branch that is a part of the Electronic Clearing System (ECS) can be identified by the use of a 9-digit identifier called Magnetic Ink Character Recognition (MICR). This code is often printed on the passbook given to the account holder and can be found on the check page issued by the bank. Clearing checks deposited in machines is the main goal of MICR codes. Also helps in troubleshooting coding errors.

Format for MICR Code

The nine-digit number’s first three digits identify the city, the second set of three numbers identify the bank, and the final set of three digits identify the bank branch. Is.For instance, the MICR code for the SBI branch in Kolkata is “700002021”. Here, the city is identified by the first three digits (‘700’), the bank is identified by the next three numbers (‘002’), and the last three digits (‘021’) designates the bank branch. Typically, MICR codes are used by machines to process and clear checks. The nine-digit number aids in minimising errors during clearance, accelerating the procedure, and enhancing the security of processing checks.

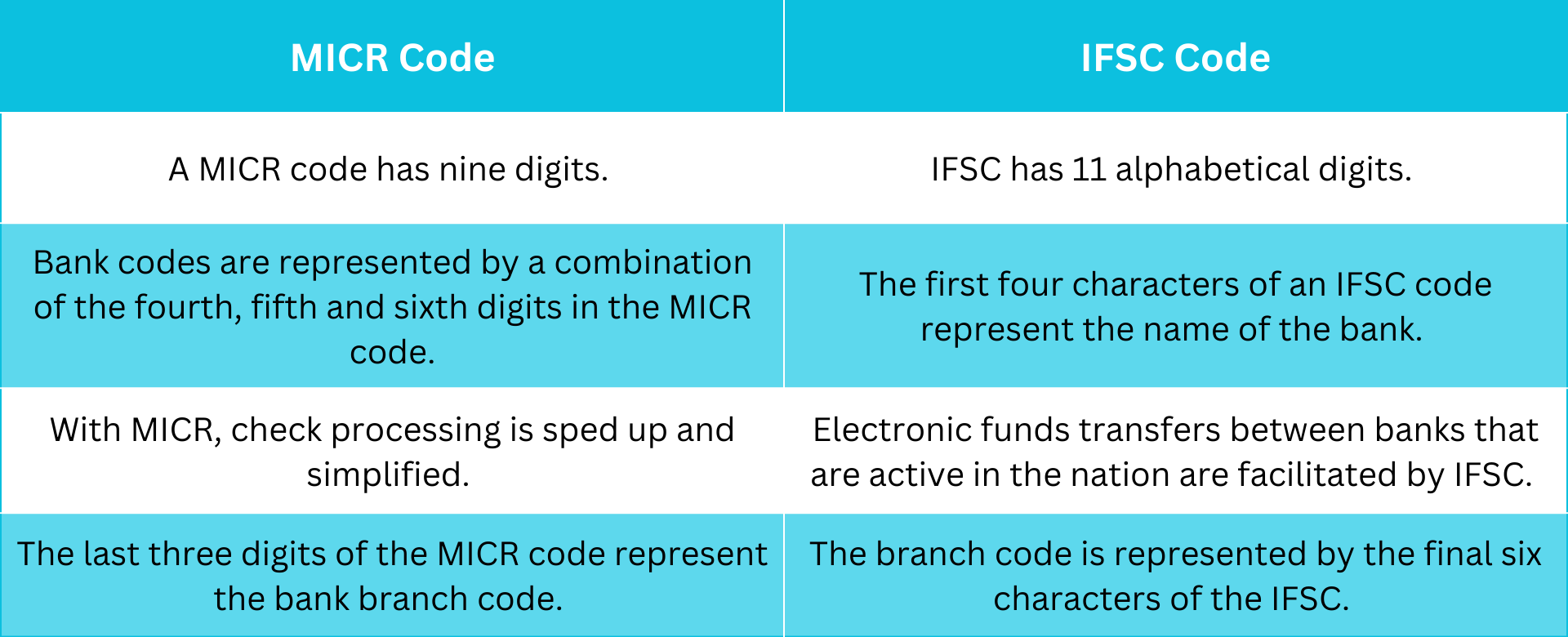

What differentiates IFSC code from MICR code?

The differences between the IFSC Code and the MICR Code are listed in the table below.

List of Top Banks’ Credit Card IFSC, MICR, and SWIFT Codes:

In this scenario the IFSC code of the bank varies from branch to branch. However, the IFSC code of a credit card of a specific bank will be the same across the country.

Some of the banks’ credit card IFSC codes are shown in the table below:

IFSC Code Lookup with GetIFSCcode:

The basic component of every online interbank money transfer in India is the IFSC code, which also serves as a reliable way of verifying all such transactions. As intended, sending and receiving money online has become simple and quick with proper understanding of IFSC codes. You can search IFSC code for specific specified bank using various web resources. And let’s face it, you’ll only double-check it when shopping online. Similarly, BankBazaar provides a comprehensive tool to help you do a quick and accurate IFSC code search. The step-by-step process to find the IFSC code on GetIFSCcode is given below:

• As you are reading these instructions, scroll to the top of the page.

• IFSC & MICR Code Directory’ is a straightforward tool that can be used to locate IFSC codes as required. The tool has four fields: 1) Select Bank, 2) Select State, 3) Select District, and 4) Select Branch.

• Please choose the name of the bank, the Indian state where the bank has its branch, the particular district of the state and finally the concerned branch carefully.

• The page that appears in response to your inquiry provides the bank’s IFSC code, MICR code, official address and phone number. In less than 30 seconds from your original question, everything happened.

How does the IFSC operate?

To better understand what IFSC code is and how it functions in banking transactions, let’s use Canara Bank’s IFSC code as an example. The IFSC Code of Chandigarh branch of Canara Bank is CNRB00001995.

• Canara Bank is the name of the bank presented here by CNBR.

• The fifth character, zero (0), is reserved for later use.

• The remaining six characters—specifically 01995—help the RBI correctly identify the bank branch.

Let us now see how IFSC operates. A specific payee must enter the unique account number and IFSC code for the branch while initiating fund transfer. After the remitter submits these details the money is sent to the account holder, and IFSC helps prevent any mistakes in such transactions.

Through online banking, apart from fund transfer, purchase of insurance and mutual funds can also be done using IFSC code. The National Clearing House of the Reserve Bank of India (RBI) keeps track of all transactions, and the IFSC code enables the RBI to do so while facilitating error-free financial transfers.

Your check book or bank passbook will also have IFSC code. In the monthly account statement, one can also get the IFSC code for their bank branch. Every branch and bank has a different IFSC code.

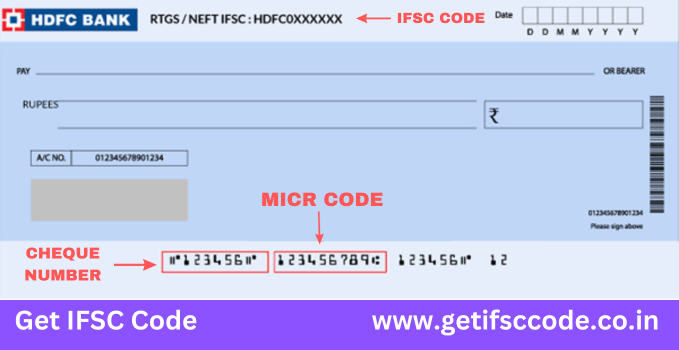

How to find the IFSC and MICR codes on a bank cheque

Ordinary bank checks have been the subject of discussion in many of the sections above. This pillar of the banking industry is made up of many elements that work together to validate its validity and give us complete confidence in its applicability.Here are some examples of the main parts of a normal bank cheque:

Locate the IFSC Code on a bank cheque:

A standard bank cheque must include the IFSC code. The IFSC codes for various banks will vary. In our example image, we are displaying the location of the IFSC code on an HDFC Cheque.

Finding the Cheque Number

Printed at the bottom of the cheque in a unique font style using a typewritten typeface. This is mostly utilised for administrative and check tracking purposes.

Discover the MICR code on a bank cheque:

Next to this is a display of the cheque number. The MICR Code, which can only be read by a Magnetic Character Ink Reader, is shown using a different typeface and ink than the cheque number.

India’s Financial System Code is necessary

We need an IFSC number because it enables RBI to accurately track all financial activities. RBI can easily trace, monitor and maintain all the financial transactions done through NEFT, RTGS and IMPS directly with the help of IFSC code.

Because most electronic cash transfers cannot be initiated without providing the beneficiary or recipient’s IFSC code along with the bank account number, IFSC codes are important for bank customers.

IFSC code is important when transferring funds from one account to another using IMPS, NEFT and RTGS. While performing this duty in different ways, each of these methods basically focuses on inter-bank money transfer. The bank IFSC code system acts as a unifying element between these different options.

Using the IFSC Code to transfer money online:

Three electronic fund transfer methods, NEFT, RTGS and IMPS, can be used to send money using IFSC code. Customers can transfer money between accounts quickly and easily with these electronic funds transfers.

Using an electronic transfer system reduces the possibility of error in transactions because proper information, such as the IFSC code of the recipient bank and bank account number, is required before the transfer is allowed.

• NEFT: National Electronic Funds Transfer is the full name of this abbreviation. As the name suggests, it deals with the transfer of funds from one bank account to another. This type of money transfer is widely used in India. To ensure that money is transferred from one bank account to another in a secure manner, the appropriate IFSC code should be provided here. Apart from IFSC code, beneficiary name, account number and account type should also be provided. The settlement process for NEFT transactions is batch-based.

• RTGS: Real Time Gross Settlement is briefly called RTGS. As the name suggests, it is a popular option for quick transfers of money (and assets) between banks without the need for waiting periods. “Real-time” (transactions occur instantly) and “gross” (refers to the fact that no additional fees will be assessed) are the key phrases here. Similar to how NEFT works, IFSC codes help in accurately identifying participating bank branches. The use of RTGS fund transfers, which are cleared instantly, is often reserved for high-value transactions. Recipient name, IFSC code, account number and transaction amount are the required details for RTGS funds.

• IMPS: Immediate Payment Service, or IMPS, is the most widely used. It was founded in November 2010 in India, thus it is a relatively new option. Money can be transferred instantly to all renowned Indian banks using this service, which is available on the customer’s mobile phone, at ATMs and online. The maximum amount that can be sent is unrestricted, and the technology is considered extremely secure, quick and affordable. Without providing IFSC code, IMPS fund transfer cannot be initiated.

How Do I Transfer Money Using My Bank’s IFSC Code?

The two primary methods of fund transmission are already known to anyone who is familiar with financial activities. One traditional method involves walking to the bank in person and depositing the cheque. The second approach is done electronically through IMPS, NEFT, or RTGS.

One does not need to register a beneficiary when using the traditional “bank-to-bank” method. However, electronic systems are quite different and far more secure.

To transfer money through technology one must meet the following requirements:

• The person needs to sign up for the bank’s online banking service.

• To engage in third-party transactions, you must register. (Remember that a beneficiary of a bank other than your bank is referred to as a third party in this context.)

• the beneficiary’s account, into which payments will be transferred, must be registered.

Making an Online Money Transfer: The Process

In India, almost all banks follow their own third-party money transfer policies. It is important to note that despite the somewhat modified wording, the method is essentially unchanged in this case.

Let’s look at the process used by HDFC Bank as an example. The steps are as follows:

• using the customer ID and password, access the bank’s online banking facility.

• Then, adhere to the simple directions by selecting the “Third Party Transfer” tab.

How Do I Register the Account of the Beneficiary?

• Beneficiary name, account number, IFSC code of the beneficiary’s bank and bank branch name all must be provided to register the beneficiary.

• Registration has ended after sending the notification. However, the time frame after which you can make your initial transfer varies between institutions. For example, in the case of HDFC Bank, it takes 12 hours for the information to be verified and activated.

A Third-Party Beneficiary: How Do I Register Them?

The steps you need to take to register a third party beneficiary for transfer of funds are listed below:

• Enter your user ID and password to get into your bank’s online banking service.

• To make a fund transfer, select the option. You’ll be taken to a different page.

• Select the ‘Add Beneficiary’ option under the ‘Request’ tab.

• Type in the beneficiary’s name, bank branch, IFSC code, and account number.

• Click “Submit” once all the information has been entered.

• You will be able to transfer money with ease after the service has had time to activate.

• You can then add the amount and a comment after you’ve added the beneficiary.

• In the following step you will be asked to select a communication method, after which a one-time password (OTP) will be sent to your email or SMS account depending on your choice.

• The beneficiary’s account will be transferred after you enter the OTP.

How to Transfer Money Using Mobile and Internet Banking?

Once this is configured, sending money electronically with the use of an IFSC code is a straightforward process. Below are the details of transferring money using mobile and internet banking:

By using Net-banking:

The steps for transferring money using online banking are listed below:

• Check out the bank’s official webpage.

• Visit the online banking site.

• Use your username and password to log in.

• Then, pick ‘Transfer funds with NEFT’ to send the money to the beneficiary’s account. The person should add the beneficiary if they haven’t already in order to register them for future transactions. The bank branch, bank account number, and IFSC code must be given in order to complete this. Depending on your bank’s policies, it may take anywhere from 5 minutes to 12 hours for the beneficiary account to be authorised after the details have been successfully submitted. Money can be promptly transferred to the beneficiary’s account with a buffer of less than an hour after waiting the predetermined number of hours.

By using mobile banking:

Using mobile banking and IFSC codes, the following steps can be taken to transfer money between bank accounts:

• To register for mobile banking, a person must first link his 10-digit mobile number to his bank account. After completing the registration form, the individual receives a startup kit with MMID (a special seven-digit number) and MPIN. The kit that comes with a debit card can be compared to this.

• After completing registration, transferring money by SMS is a simple process. The person must first choose ‘IMPS’. The sender must next enter the beneficiary’s account number, IFSC code, and the amount they wish to send. The individual is required to key in the mPin after confirming the transaction. Therefore, the funds are successfully moved from the account and put into the beneficiary’s account.

What exactly is Unified Payment Interface (UPI)?

It is essentially a new payments architecture that was set up by the Reserve Bank of India under the direction of former governor Raghuram Rajan with the help of tech veteran Nandan Nilekani. In short, UPI is touted as the next generation payment system, which is expected to harness the growing power of smart phone technology and the corresponding increase in smart phone users in the country. It enables one to use a smart phone to conduct financial transactions between any two bank accounts. Even though UPI payment system supports online and offline transactions like net banking and card swipe, it is more intuitive and intelligent at the same time.

How Can I Send Money Online?

What you need to do to e-Transfer money from one account to another is described below:

• To send money from one account to another by e-transfer, you need to sign up for the bank’s online banking services.

• To be able to transfer money to the recipient’s account whenever and as often as you want, you need to add the beneficiary by providing their information including their name, bank account, IFSC code and bank branch.

FAQs about the IFSC and MICR codes

-

What is IFSC code?

(IFSC code is a unique code used in electronic fund transfers.)

-

How do I find my bank’s IFSC code?

(You can find it on your bank’s website or on a check.)

-

What does IFSC stand for?

(The Indian Financial System Code is referred to as IFSC.)

-

Why are IFSC codes necessary?

(They are required in electronic transactions to identify bank branches.)

-

Can you explain the structure of an IFSC code?

(It’s an 11-character code with a combination of letters and numbers.)

-

Is IFSC code the same for all branches of a bank?

(No, each branch has a unique IFSC code.)

-

How do the MICR and IFSC codes differ from one another?

(MICR is used for paper-based clearing while IFSC is for electronic transfers.)

-

What does MICR code stand for?

(The term MICR (Magnetic Ink Character Recognition) is used.)

-

Where can I find my bank’s MICR code?

(You can find it on a check next to the account number.)

-

Can IFSC codes be used for international transactions?

(No, they are primarily for domestic transactions.)

-

How can I transfer money using the IFSC code?

(You must include the recipient’s IFSC code and account number.)

-

Is there a fee for using IFSC codes for transfers?

(Banks may charge a nominal fee for some transactions.)

-

Can you change your IFSC code?

(No, it’s assigned to the branch and cannot be changed by the account holder.)

-

How does the Reserve Bank of India fit into IFSC codes?

(RBI assigns IFSC codes to banks.)

-

How can I verify the accuracy of an IFSC code?

(You can double-check it with your bank or on the RBI website.)

-

Can you explain the significance of the first four characters in an IFSC code?

(They represent the bank’s name.)

-

What is the purpose of the fifth character in the IFSC code?

(It’s usually a zero and is reserved for future use.)

-

How do I know if I’ve used the correct IFSC code for a transaction?

(Double-check with your bank and the recipient.)

-

What are the benefits of using IFSC and MICR codes in banking?

(They ensure secure and accurate fund transfers.)

-

Are IFSC and MICR codes case-sensitive?

(No, they are not case-sensitive.)

-

How long does it take for a bank transfer using IFSC code to be processed?

(It’s usually done within a few hours to one working day.)

-

Can you transfer money using MICR codes online?

(No, MICR is for paper checks.)

-

What’s the role of the branch code in an IFSC code?

(It identifies the specific branch.)

-

Are there any restrictions on the use of IFSC codes?

(They are meant for authorized financial transactions.)

-

Can you use IFSC codes to pay utility bills?

(In some cases, yes, you can use them for bill payments.)

-

Can you share your IFSC code with anyone?

(It’s safe to share it for receiving payments.)

-

How many characters are there in a MICR code?

(MICR codes consist of 9 digits.)

-

Are there any specific security measures associated with IFSC codes?

(Keep your code confidential to prevent fraud.)

-

Can foreign banks have IFSC and MICR codes in India?

(Yes, foreign banks operating in India have these codes.)